Answer:

Fletcher

.b. $3,570 unfavorable

Summerline

e. $2,950 unfavorable

Grant

b. $6,000U

Step-by-step explanation:

First Company Fletcher

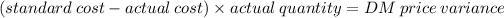

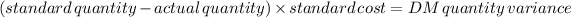

DIRECT MATERIALS VARIANCES

std cost $ 2.00

actual cost $ 1.99 ($483,570 actual cost/ 243,000 actual lbs)

quantity 243,000

difference $ 0.01

price variance $2,430.00

The diference is positive, we saved cash from the purchase of direct materials, the variance is favorable.

std quantity 240000.00

actual quantity 243000.00

std cost $2.00

difference -3000.00

efficiency variance $(6,000.00)

The diference is negative, we used more lbs than we expected, this variable is unfavorable

Total:

2,430 - 6,000 = -3,570

Second company Sumerlin

DIRECT MATERIALS VARIANCES

For this company, all the values are given we just need to plug into the formula

std cost $5.00

actual cost $5.10

quantity 4,500

difference $(0.10)

price variance $(450.00)

The actial price is higher so it is more expensive. The difference with the standard is negative. The vaiance is unfavorable

std quantity 4000.00 (is a given "budget 4,000 for 2,000 units")

actual quantity 4500.00

std cost $5.00

difference -500.00

efficiency variance $(2,500.00)

Total

-450 - 2,500 = -2,950

Third Company Grant

23,000 units x 2 hs = 46,000 standar hours

46,000 x $4 per unit = 184,000 standard variable overhead

actual overhead (190,000)

variance (6,000) unfavorable, the actual cost are higher than it should be.