Answer:

stock price =$87.12

Step-by-step explanation:

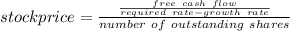

stock price is given as

where,

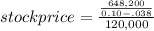

free casg flow = $6,48,200

required growth = 10%

growth rate = 3.8% = .038

number of outstanding shares = 120,000

putting all value to get stock price

stock price =$87.12