Answer:

Current price of Brown Company = $17.68

Step-by-step explanation:

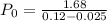

Using dividend growth model we have

Where,

= Current price of share

= Current price of share

= Dividend to be paid at year end = $1.68 as provided,

= Dividend to be paid at year end = $1.68 as provided,

= Cost of equity or expected return on equity = 12% as provided,

= Cost of equity or expected return on equity = 12% as provided,

g = growth rate = 2.5% as provided,

Now putting the values in above we have

Current price of Brown Company = $17.68

This is the price every person would be willing to pay at current level.