Answer: Option A

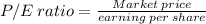

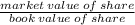

Explanation: P/E ratio can be calculated using following formula :-

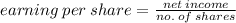

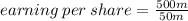

where,

= $10

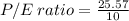

putting the values into equation we get :-

= 2.57

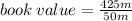

similarly, market-book ratio can be calculated as follows :-

where,

= 8.5

now putting the values into equation, we get :-

= 3.01