Answer:

new BEP in units = 3,750

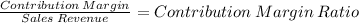

Contribution Margin Ratio 0.40

Step-by-step explanation:

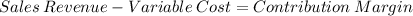

The variable cost decrease by $10 to $60 from 70

The fixed cost increase by 30,000 to $150,000 from $120,000

sales remains at $100

100 - 60 = 40 CM Each units contribution is $40

40/100 = 0.40 CMR for each dolalr of sales 40 cents are contribution

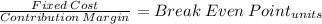

150,000/40 = 3,750 by selling 3,750 the company can afford to pay their fixed cost.