Answer:

WACC 8.56000%

Step-by-step explanation:

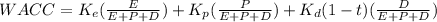

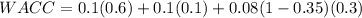

We will caclculate the WACC with Preferred Stock

D 30 millions

E 60 millions

P 10 milliions

V 100 millions

Ke 0.1

Equity weight 0.6 (60/100)

Kp 0.1

Preferred Weight 0.1 (10/100)

Kd 0.08

Debt Weight 0.3 (30/100)

t 0.35

WACC 8.56000%