Answer:

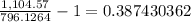

RoR = 38.74%

Step-by-step explanation:

We need to know the value of the bond at the moment of the purchase.

That will be the present value of the coupon payment and the maturity date. Both measurement should be done using 12.69 rate

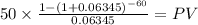

C 50 (1,000 x 10% /2) The bond pay semiannually

time 60 (30 years and 2 payment per year)

rate 0.06345 (12.69 annual rate / 2 = 6.345% semiannually rate)

PV $768.3652

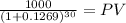

Maturity 1000

time 30

rate 0.1269

PV $27.7612

PV c $768.3652

PV m $27.7612

Total $796.1264

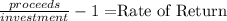

Proceeds: 1,004.57 sales price + 100 cuopon payment for the year

It purchase at 796.1264

RoR = 38.74%