Answer:

2. 7.1%

Step-by-step explanation:

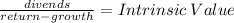

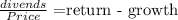

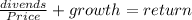

We use the formula to calculate the return of the Gordon Model:

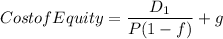

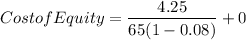

Because the issue of new share has a flotation cost, it must be discount from the share price, giving us the final formula:

D1 4.25

P 65

f $0.08

g 0 (there is no growth stimated so we assume zero)

Ke 0.071070234

Ke = 7.1070% = 7.1%