Answer:

$1,614,000

Step-by-step explanation:

given,

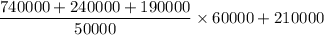

Indirect labor cost = $740000

Machine supplies = $ 240000

indirect material cost = $ 190000

Depreciation on factory building = $ 210000

Total manufacturing overhead = $1380000

A flexible budget for a level of activity of 60,000 machine hours

total manufacturing overhead costs of:

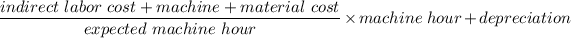

=

=

= $1,614,000