Answer:

Amount reported in Income Statement from investment in Eagle Co. = $18,000

Step-by-step explanation:

Shares purchase date = 1 July 1992

Number of shares = 3,000

Total shares = 10,000

Percentage of holding = 3,000/10,000 = 30%

Cost of shares = 3,000

$20 = $60,000

$20 = $60,000

Provided dividend received on Dec 15 1992

That is dividend for the year = $40,000

Dividend per share = $40,000/10,000 = $4 per share

Dividend on 3,000 shares = 3,000

$4 = $12,000

$4 = $12,000

This will be deducted from cost as dividend received from a company in which share holding is 20% or more than equity method is applied and thus, cost will be $60,000 - $12,000 = $48,000

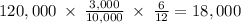

Further provided Eagle Co's income for the year = $120,000

Shares purchased and held for 6 months

Share of income =

This shall be added to cost and also the income statement, of the Denver Corp.

Carrying value of Eagle's Shares = $48,000 + $18,000 = $66,000

Final Answer

Amount reported in Income Statement from investment in Eagle Co. = $18,000