Answer:

ke=16.29

Step-by-step explanation:

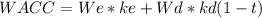

Where:

We=weight of common equity in the capital structure

ke=cost of equity

Wd=Weight of debt in the capital structure

kd= Cost of debt i.e yield to maturity on the bonds

t= tax rate.

Since WACC is estimated to be 12.9%

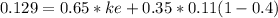

![ke=(0.129-[0.35*0.11(1-0.4)])/(0.65)](https://img.qammunity.org/2020/formulas/business/college/3ahd352c67pfvkj5pq2ldvk4b921ptuj7n.png) =0.162923

=0.162923