Answer:

WACC 0.1030590%

Step-by-step explanation:

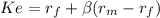

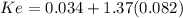

First we use CAPM to solve the Cost of Equity

risk free 0.034

market rate

premium market market rate - risk free 0.082

beta(non diversifiable risk) 1.37

Ke 0.14634

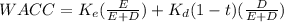

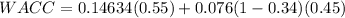

Then we calculate the WACC

Ke 0.14634

Equity weight 0.55

Kd 0.076

Debt Weight 0.45

t 0.34

WACC 0.1030590%