Answer:

Cynthia will have to pay $152.16 extra in finance charges.

Explanation:

Cynthia had a credit card with a 17% APR and a $3,265 balance.

Cynthia’s credit card company has increased her interest rate to 21%.

Here we have two scenarios, 1st when p = 3265 r = 17% and n = 24

Second when p = p = 3265 r = 21% and n = 24

Scenario 1:

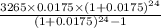

EMI formula is :

Putting the values in formula we get;

=

EMI = $161.43

Scenario 2:

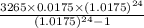

r =

Putting the values in formula we get;

=

EMI = $167.77

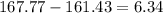

Now, difference in EMI's =

dollars

dollars

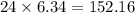

And for 24 months this amount becomes =

dollars

dollars

Therefore, Cynthia will have to pay $152.16 extra in finance charges.