Answer:

Net Present Value = $1,762.95

Step-by-step explanation:

Equal payments made at the end of each year implies that the cash inflows from year 1 to 7 form an annuity where:

![PVof An Ordinary Annuity= (PMT[1-(1+i)^(-n) ] )/(i)](https://img.qammunity.org/2020/formulas/business/college/cvdoe2221e4pd6gkokwce6u0zzhtyu95k7.png)

where PMT is the the equal payment cash inflow received at the end of each period and

![([1-(1+i)^(-n) ] )/(i)](https://img.qammunity.org/2020/formulas/business/college/s9fwaas7b89a7cb30v0t5tewjqkjvh5iov.png) = The present value of an annuity factor for n years at i%

= The present value of an annuity factor for n years at i%

The present value of an annuity factor for 7 years at 10% equals

![([1-(1+0.1)^(-7) ] )/(0.1)=4.8684](https://img.qammunity.org/2020/formulas/business/college/lfo6977qdyp45ucldyfs9v3ec0pmna9euk.png)

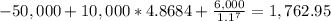

therefore: Net Present value of this investment given a 10% return o investments equals