Answer: The expected annual return of this portfolio is 12%.

Step-by-step explanation:

Given that,

Total value of portfolio = $50,000

$25,000 will be invested in asset R and expected annual return of 12 percent

$10,000 will be invested in asset J, with an expected annual return of 18 percent

$15,000 will be invested in asset K, with an expected annual return of 8 percent

Expected return is the sum of their investment portfolio times their expected returns.

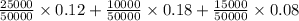

Return on portfolio =

= 0.06 + 0.036 + 0.024

= 0.12

= 12%

∴ The expected annual return of this portfolio is 12%.