Answer: The expected annual net cash savings from the new software is $16500.

Step-by-step explanation:

Given that,

Cost of the software package = $ 66,000

Expected life = 10 years

Investment Payback = 4 years

Salvage value = 0

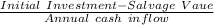

Payback period =

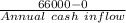

4 =

Annual cash inflow =

= 16500

∴ The expected annual net cash savings from the new software is $16500.