Answer:

It wouldb e fair to pay up to $10,824.7917

Step-by-step explanation:

The asset will be yielding 15 payment

so we will calculte the present value using annuity for 2000 dollar time = 15

rate = 0.08 annual

We will convert this rate to bi-annual

(1.08 power 2) - 1 = 0.1664

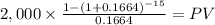

Now we calculate the annuity present value

C= 2000

time = 15

rate = 0.1664

PV = $10,824.7917