Answer:

MACHINE 7745: -20,862.72

MACHINE A37Y: -18,281.02

Step-by-step explanation:

production: 30,000,000

Machine 1

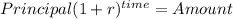

cost 10,000

life 10 years

salvage value 1,000

operating cost 0.01 per 1000 units. 0.01 x 30,000,000/1,000 = 300

Minimun accepted rate of retrun 6%

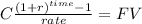

Future value of the Operating cost

C = 300

r = 0.06

time = 10

FV -$3,954.24

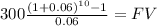

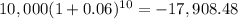

Future Value of the Investment

Total -17,908.48 - 3,954.24 + 1,000 = -20,862.72

Machine 2

8,000

life 10 years

no salvage value

operating cost 300

FV of the operating cost: - 3,954.24

FV of the Investment: -14,326.78

Total: -3,954.24 - 14,326.78 = -18,281.02

Edit: sorry but the math toll is not working as it should be =(