Answer:

B. Debit Cost of Goods Sold $839,300

Step-by-step explanation:

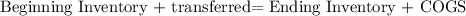

We solve this using the inventory identity

160,500 + 837,000 = 158,200 + COGS

160,500 + 837,000 - 158,200 = COGS

COGS 839,300

This is a general concept in accounting

there is a beginning balance and a transaction or production that increase it.

which should be equal with the ending balance and the transaction or event that decrease it.