Answer:

Flip's taxable income for the current year is $2,10,000.

Step-by-step explanation:

Given information:

Advertising Expenses = $50,000

Cost of Goods Sold = $660,000

Other Operating Expenses = $390,000

Sales = $1,830,000

Wages and Salaries = $520,000

Capital Gain = $15,000

The formula for taxable income is

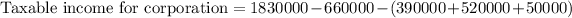

Taxable income for corporation = Gross Sales - cost of goods sold - operating expense - Interest expense - Tax deduction/ credit

Where,

Operating expense = Advertising Expenses + Wages and Salaries + Other Operating Expenses

Using this formula we get

Therefore, Flip's taxable income for the current year is $2,10,000.