Answer:

Giselle should purchase points to lower the interest rate of the mortage, this will make the cuota decrease.

Step-by-step explanation:

163000 x20% = 32,600

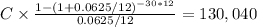

163,000 - 32,600 = 130,040

current mortgage cuota:

C= 800.68

800.68/ 2,986 = 0.2681 = 26.81%

this cuota exeeds the desired amount Giselle wants.

her couta can be as much as 2,986 x 25% = 746.5

Giselle should purchase points to lower the interest rate of the mortage, this will make the cuota decrease.