Answer:

It will be a better offer the option B because it yield a higher net present value at the given rate.

B 88,457

A 86,755

C 85,000

Step-by-step explanation:

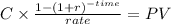

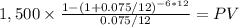

We are going to compare the present value of each annuity at the cost of capital rate 7.5%

option A

C= couta, monthly payment 1,500

rate= 0.075 is an annual rate we divide by 12 to get the monthly rate

time = 6 years = 6*12 = 72 months

option A PV = 86,754.78646

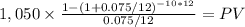

option B

C = 1,050

time = 10 years

same rate

option B PV = 88,456.97984

option C = 85,000

It will be a better offer the option B because it yield a higher net present value at the given rate.