Answer: Under the free cash flow valuation model, free cash flows in future are projected. These are discounted by the adjusted capital cost i.e. (debt and equity).

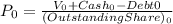

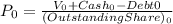

Therefore, the appropriate way to calculate the price of a share of a given company using the free cash flow valuation model is given as :

Here, the correct option is (a). i.e.