Answer:

Accounts Receivables Turnover Ratio =

= 10 times.

= 10 times.

Step-by-step explanation:

Accounts Receivables Turnover ratio =

Here Net Credit Sales = $6.5 million

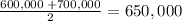

Accounts Receivables Opening Balance = $600,000

Accounts Receivables Closing Balance = $700,000

Average Accounts Receivable Balance =

Accounts Receivables Turnover Ratio =

= 10 times.

= 10 times.

This shows that accounts receivables are on an average 1/10th of credit sales.

Final Answer

Accounts Receivables Turnover Ratio =

= 10 times.

= 10 times.