Answer: Annual rate of return = 21.89%

Step-by-step explanation:

Given that,

Expected increase in annual revenues by = $140000

Expected increase in annual expenses by = $88,000 including depreciation

Cost of oil well = $465,000

salvage value at the end of its 10-year useful life = $10,000

Expected Income = Expected increase in annual revenues - Expected increase in annual expenses

= 140000 - 88000

=$52000

Average investment =

= $237500

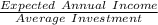

Annual rate of return =

=

= 21.89%