Answer:

Present value of the bonds 935.82

Step-by-step explanation:

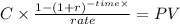

We have to calculate the present value of the coupon interest service

and the face value redeem at maturity.

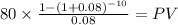

C = 1000 x 0.8 = 80

rate = 9%

time = 10

PV = 513.41262

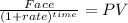

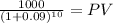

Face Value = 1000

rate = 0.09

PV = 422.410807

Present value of the bonds

annuity PV + face PV = market price

513.41262 + 422.410807 = 935.823427 = 935.82 market value