Answer:

Given:

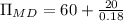

Monopolist earns = $60 million

The opportunity cost of funds = 18 %

The monopolist will earn = $20 million after another firm enters the market

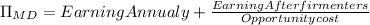

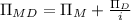

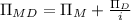

The present value of the monopolist’s current and future earnings if entry occurs can be computed using the following formula:

The present value of the monopolist’s is $171.1 million

If the monopolist can earn $35 million indefinitely by limit pricing,then the present value of the monopolist’s current earnings:

∴ If the monopolist can earn $35 million indefinitely by limit pricing, then they should do so.