Answer:

B. It does not consider past earnings and performance.

Step-by-step explanation:

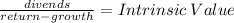

The formula use the expected nextyear dividends,

the expected growth on the dividends

and the cost of capital.

It doesn't include anything related to previous earnings and performarce. Like net income, net loss, increase in equity, increase in assets or any other variance about the company's composition of his capital and income.