Answer:

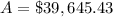

You should choose an account with a 7% annual interest rate which is compounded quarterly

Explanation:

we know that

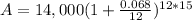

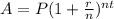

The compound interest formula is equal to

where

A is the Final Investment Value

P is the Principal amount of money to be invested

r is the rate of interest in decimal

t is Number of Time Periods

n is the number of times interest is compounded per year

part 1)

we have

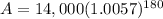

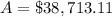

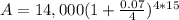

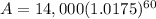

substitute in the formula above

part 2)

we have

substitute in the formula above