Answer:

The cash flow should be equal to 88,634.74

Step-by-step explanation:

218,000 investment on fixed assets

41,000 working capital

investment at year 0 259,000

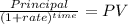

present value of salvage value

79,900

time = 3 years

rate = 0.14

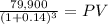

PV 53,222.75

259,000 - 53,222.75 = 205,777.25 present value of the operating cash flow

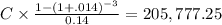

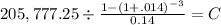

Now we have to calcualte the cuota of a 3 years annuity of present value equal to 205,777.25 at 14% rate

C = 88,634.74

The cash flow should be equal to 88,634.74