Answer:

Net Present Value: 362,855

Step-by-step explanation:

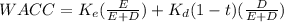

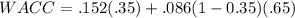

First we need to calculate the WACC to know the required return of the project.

Ke = 0.152 (0.137 cost of capital+ 0.015 subjective risk)

ER = 0.35 = E/(E+D)

Kd = 0.086

DR = 0.65 = D/(E+D)

t = 0.35

WACC 8.95350%

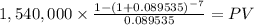

Then we calcualte the net present value:

Present value of the cash flow

C= 1,540,000

rate = 8.9535%

time 7 years

PV = 7,762,855

Present value of the cash flow - Investment = NPV

7,762,855 - 7,400,000 = 362,855