Answer:

Cost of common equity assuming equity comes from retained earning = 13.26%

Cost of common equity from new stock = 14.52%

Step-by-step explanation:

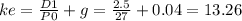

From the constant growth model:

where P0=$27; D1=$2.50; g = 4%

If the company is using retained earnings, it does not incur any flotation costs as it just retains earnings instead of paying them out as dividends.

therefore from the above equation, if we solve for ke, we get:

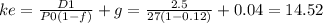

If the company issues new stock, it will effectively receive less that $27 per share as 12% will have to go towards flotation costs. ke in this case will be:

Flotation costs effectively increase cost of capital.