Answer:

Maximum initial cost would be $58,116,883.12

Step-by-step explanation:

1,790,000 increased at 3%

Ke 0.119 + 0.02 = 0.139

ER 0.15

Kd(after-tax) Kd(1-t) = 0.047

DR 0.85

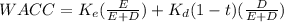

WACC 0.06080

Now that we have the rate, we calculate the present value using the gordon method

1,790,000 / (0.06080-0.03) = 58,116,883.12