Answer:

a) $235.65

b) $57,499.58

Explanation:

Tax rate is 1 mill or $0.001 on every $1 of appraised value. This means the tax rate is:

Tax rate = $0.001 per $1 =

Part a)

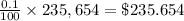

Appraised value of medical center = $ 235,654

Tax rate = 0.1%

Tax Amount due = 0.1% of $ 235,65 =

Thus, the tax due for 1 mill is $235.65 rounded to nearest cent.

Part b)

New Tax rate = 244 mills =

Tax rate is 1 mill or $0.001 on every $1 of appraised value. This means the tax rate is:

Tax rate = $0.244 per $1 =

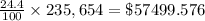

Tax Amount due = 24.4% of $ 235,65 =

Thus, the tax due for 244 mills is $57,499.58 rounded to nearest cent.