Answer:

(a) Asset turnover ratio = 3.62 times

(b) Profit margin = 3%

Step-by-step explanation:

(a) Asset turnover ratio is computed to calculate the sales relative to the company's assets.

It's formula =

Where net sales are taken as it is from income statement and average assets is the sum of opening and closing assets divided by two.

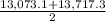

Average assets here =

=

= $13,395.2

= $13,395.2

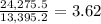

Net Sales = $24,275.5

Asset turnover ratio =

(b) Profit margin =

This ratio is calculated in percentage and this is to evaluate the company's net margin on sales.

Profit margin =

= 3%

= 3%

Final Answer

(a) Asset turnover ratio = 3.62 times

(b) Profit margin = 3%