Answer:

rd+premium = 10.5%

using CAPM = 10.3%

Step-by-step explanation:

Under bond-yield+ risk-premium approach

This method simply propose to add the bond yield with the estmated risk premium:

0.065 + 0.04 risk premium = 0.105

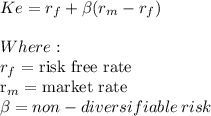

r_f = 0.055

β = 0.8

(r_m-r_f) = 0.06

0.055 + 0.8(0.06) = 0.103 cost of capital using CAPM