Answer:

Part I

Net Present Value = $9,860

Part II

Annual rate of Return = 8.5%

Step-by-step explanation:

Part I

Calculating net present value = Present value of cash inflow - Present value of cash outflow.

Present value of cash outflow = $70,000

Present value of cash inflow = Annual cash inflow X Present value factor @ 8 % for 5 years

= $20,000 X 3.993

= $79,860

Net Present Value = $79,860 - $70,000 = $9,860

Part II

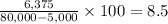

Capital outlay = $80,000

Salvage value = $5,000

Annual net cash inflow = $6,375

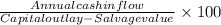

Annual rate of return =

=

Final Answer

Part I

Net Present Value = $9,860

Part II

Annual rate of Return = 8.5%