Answer: Cash to be distributed to Harding = $ 17000, Jones = $ 3000

Step-by-step explanation:

It has been indicated that the ($9,000) deficit will be covered with a forthcoming contribution

∴ The Remaining Capital Balance is = (24000 + 24000) = $48000

∵Total cash Available = $20000

Loss = 48000 - 20000 = $ 28000

Loss will be shared between Harding & Jones in ratio = 16:48

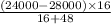

∴ Harding Capital balance =

= $ 17000

= $ 17000

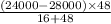

∴ Jones Capital balance =

= $ 3000

= $ 3000

Cash will be Distributed in their capital balance ratio

Therefore,

Cash to be distributed to Harding = $ 17000, Jones = $ 3000