Answer:

real rate = 0.214051525

Your friends are right

Step-by-step explanation:

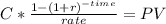

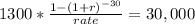

We have to calculate the rate at the present value of an annuity of 30 monthly payment of 1,300 which equals 30,000

we use excel, iteractive process or a financial calculator to solve for rate

0.0178376

this rate will be the monthly rate, we need to multiply by 12

0.0178376

x 12

0.214051525