Answer:

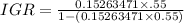

IGR = 9.1640%

Step-by-step explanation:

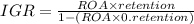

.45 dividend payout ratio

1 - .45 = .55 retention ratio

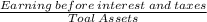

ROA = Return on Assets

Income before taxes 6,200

Assets 11,820 + 28,800 = 40,620 Total Assets

ROA 6,200 / 40,620 = 0.15263417

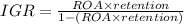

IGR = 0.09164031 = 9.1640%