Answer:

C. $25,000 overallocated.

Step-by-step explanation:

160,000 / 12,000 = 13.33333333 = 13 + 1/3 (to avoid rounding issues)

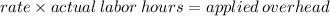

Applied Overhead

(13 + 1/3) * 15,000 = 200,000

Actual Overhead (175,000)

Overapplied for 25,000

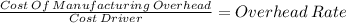

Remember that the overhead is done by distributing the estimated overhead cost over a cost driver, which usually is direct labor or machine hours