Answer:

A higher discount rate generated a lower present value.

plaintiff at 11% offers $6,348,861.951

insurance offer at 5% ask for $3,311,888.802

Insurance is lower by (2,677,26.851)

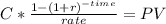

Step-by-step explanation:

A higher discount rate generated a lower present value.

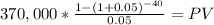

settlement at 5%

annuity of 370,000 for 40 years

PV = 6,348,861.951

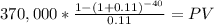

settlement at 11%

PV = 3,311,888.802

Diference between values

6,348,861.951

(3,311,888.802)

(2,677,26.851)