Answer:

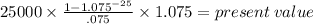

(B) 299,574

Step-by-step explanation:

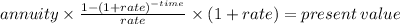

We have to calculate the present value of an annuity-due of 25,000

That's because it is being paid in advance.

299574.17

Remember: when the payment or receipts are made in advance, AKA at the beginning of the period, multiply the annuity formula for (1+rate)

That's because the annuities are held for 1 more period than usually.