Answer:

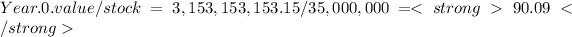

The stock's value per share is $90.09.

Step-by-step explanation:

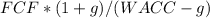

In order to estimate the value of the share, first we have to estimate the value of the company at year 0 (today). We start from the FCF, that is equal to 200,000,000 (year 1). The formula of the company's value is

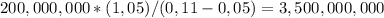

, where g is the constant rate of grow (5%). So, the value of the company at year 1 is

, where g is the constant rate of grow (5%). So, the value of the company at year 1 is

.

.

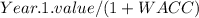

The next step is to obtain the value at year 0, with the formula

. So

. So

Finally, the stock's value per share is