Answer:

expected return = 12.03%

Step-by-step explanation:

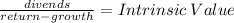

using the dividends growth model we can calculate the required return

2.22 x 1.03 = 2.2866

We must remember that the gordel model is used with next year dividends

2.2866(return - 0.023) = 19

2.2866/19 +0.023 = return

return = 12.03%