Answer:

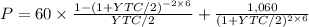

YTM = 8.93%

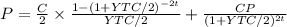

YTC = 8.47%

Step-by-step explanation:

The first part is the present value of the coupon payment until the bond is called.

The second is the present value of the called amount

P = market price value = 1,200

C = annual coupon payment = 1,000 x 12% 120

C/2 = 60

CP = called value = 1,060

t = time = 6 years

Using Financial calculator we get the YTC

8.467835879%

The first part is the present value of the coupon payment until manurity

The second is the present value of the redeem value at maturity

P = market price value = 1,200

C = coupon payment = 1,000 x 12%/2 = 60

C/2 = 60

F = face value = 1,060

t = time = 10 years

Using Financial calculator we get the YTM

8.9337714%