Answer:

(A) payback in 3.42 years

(B) It doesn't payback in six years. payback is 6.66 years

Step-by-step explanation:

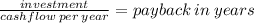

(A) because discount rate is zero we are doing the payback period

10000 investment / 2920 per year = 3.4246

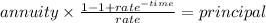

(B) here there is a discount rate so we need to solve ussing the annuity formula for the time which makes the 2,920 cash flow equal to 10,000

we post our givens in the formula

we pass the annuity and rate to the second part of the equation

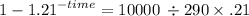

10,000/2920*0.21= 0.7191...

for rounding porpuses I will refer to this as "a"

This means you have to work with the complete number, don't round it.

then, we work the equation a little more to reach this structure

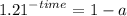

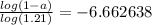

finally, we use log properties to solve for time

-time = -6.662638

time = 6.662638

But the project life is six years... so the project doesn't payback at this discount rate.