Answer:

(1)

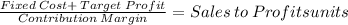

BEP units 12167

BEP dollars 486,667

(2) BEP CM = Fixed Cost = 147,600

(3)

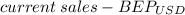

17,158

(4)

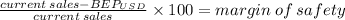

Margin 137,333

Margin percent of sale 22%

(5)

The CM ratio does not change, because the variable expenses increase as well. In the given information are the fixed cost which doesn't change. they have no impact in the contribution calculation. So CM keps at 30%

The operating income will increase by ↑Sales x CMR

↑78,000 x .3 = ↑23,400

Step-by-step explanation:

(1)

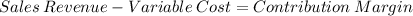

40 - 28 = 12

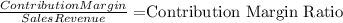

12/40 = 0.30

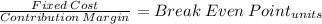

147,600/12 = 12166.67 = 12167

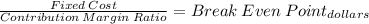

147,600/0.3 = 486666.67

(3)

(147,600 + 58,300)/12 = 17,158.33 = 17,158

(4)

624,000 - 486,667 = 137,333

137,333/624,000 x 100 = 22.008%