Answer:

It was raised $236,009.52

Step-by-step explanation:

The YTM is 6.43

so we need to calculate the market price of the bond using this rate.

Market price will be equal to the cash raised from the sale.

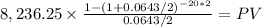

1st annuity of 20 years semiannual payment of

275,000 x 0.0599/2 = 8236.25

PV = 183,932.289662

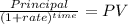

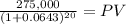

2nd we have to calculate the prsent value of the redeemption of the bond

PV = 79,0773.23051

Now we add both values to get the cash proceeds from the bond

79,0773.20351 + 183,932.289662 = 236,009.52