Answer:

Intrinsic Value = $38.0025

Step-by-step explanation:

![\left[\begin{array}{ccc}Year&Dividends&Present \: Value\\0&1&-\\1&1.2&1.0984\\2&1.44&1.2065\\3&1.728&1.3252\\4&2.0736&1.4556\\5&51.2301&32.9168\\Intrinsic&Value&38.0025\\\end{array}\right]](https://img.qammunity.org/2020/formulas/business/college/d4o22lccycu4rhorbkq8uqzvw1at7ssbls.png)

Fist, we calcualte the increase of the dividends, by multipling by (1+growth) 1.20 until year 4.

At year 5 we multiply by 1.05

Because from here the company will have a fixed growth rate, we can apply the dividend growth model

1.52838/ (0.0925-0.05) = 51.2301

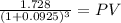

Next we have to bring all these dividends, which are placed in futures date, to present value:

for example

PV = 1.3252

Lastly, we add all the PV to get the intrinsic value of the share today.